single life annuity vs lump sum

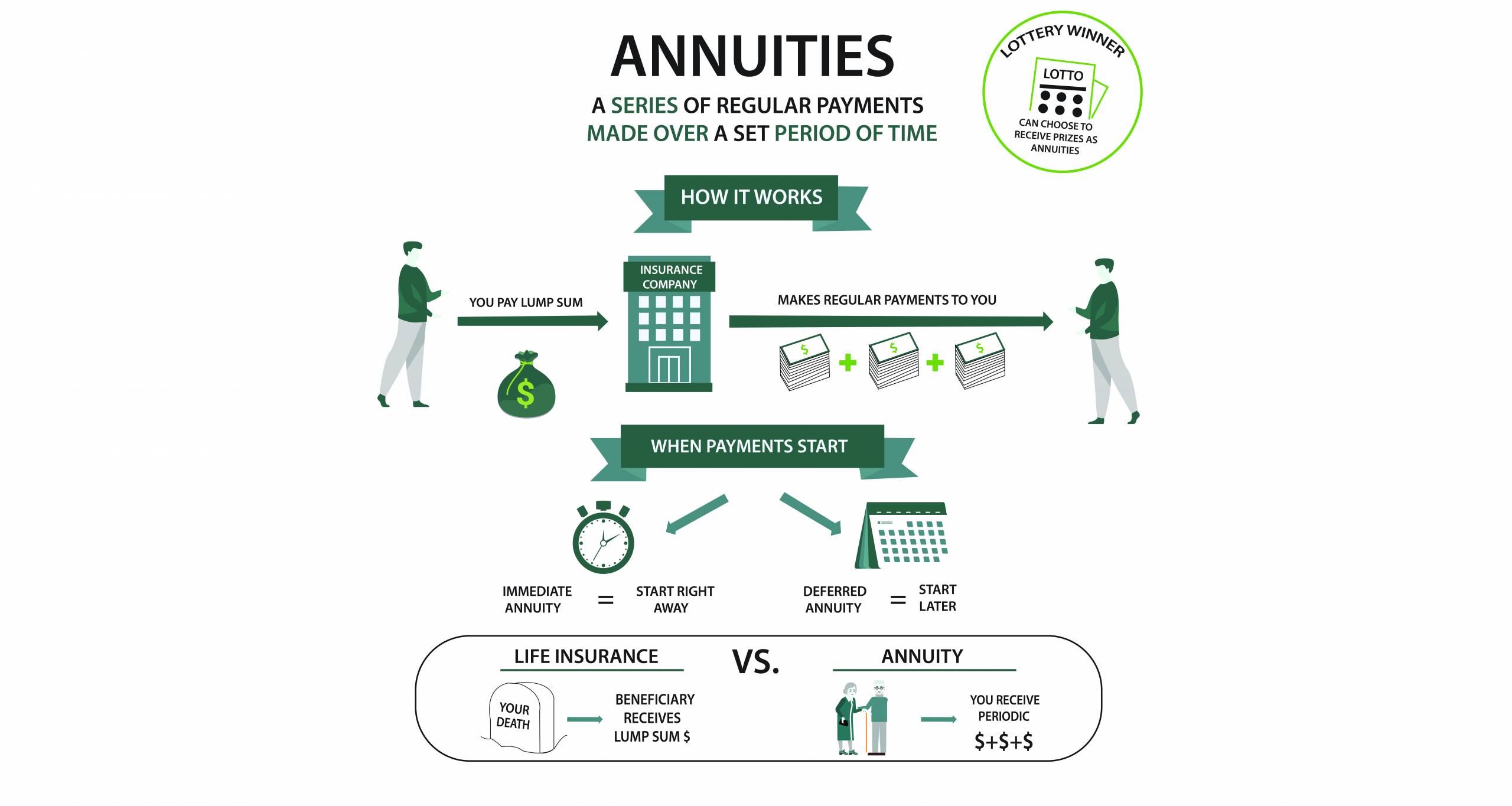

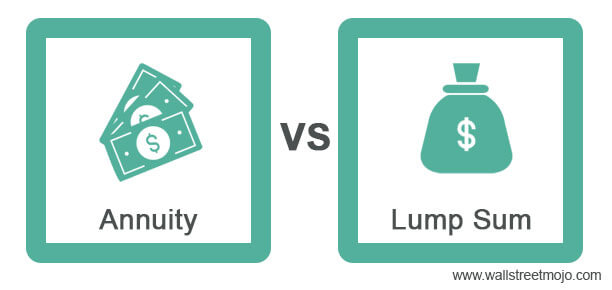

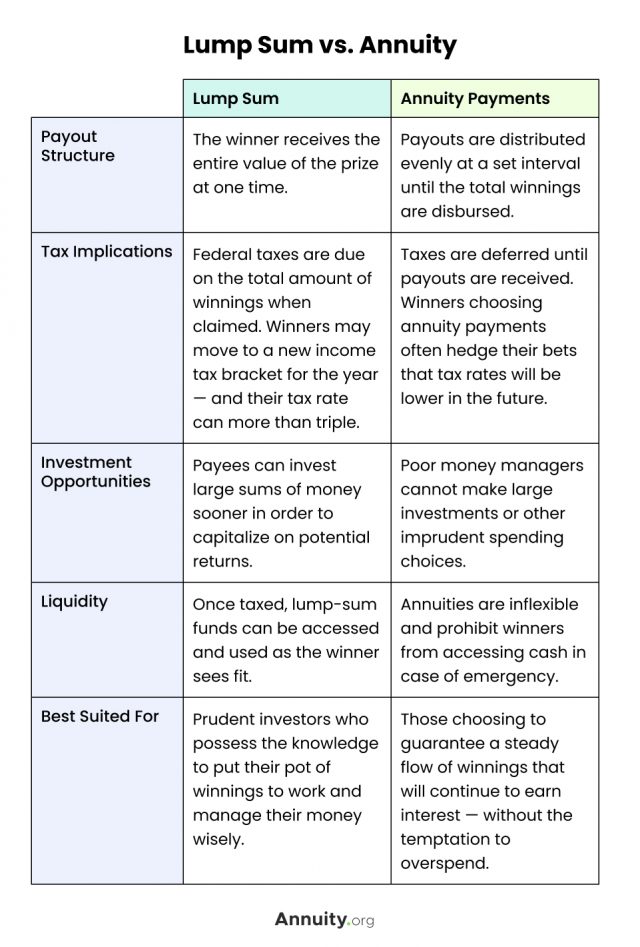

A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. Annuity or Lump Sum.

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Ad Find Lifetime annuity.

. Monthly Pension Benefit Payable at normal retirement date single life annuity 74874. Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity. External Links Disclaimer If you.

Both options offer retirees. Learn some startling facts. CHEAPER THAN RETAIL ANNUITIES Your pension annuity almost always provides a higher annual amount versus what you would receive if you purchased a retail annuity with the lump.

Learn some startling facts. Ad True Investor Returns With No Risk. Ad 11 Tips You Must Know About Retirement Annuities Before Buying.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. It is useful to take high investing. But at retirement people should.

Ad Learn More about How Annuities Work from Fidelity. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for. Find Lifetime annuity at SpeedyResultsNow.

People trying to decide between a lump sum or an annuity often focus on whether they could earn more by investing the lump sum Russell says. Lump-sum on the other hand would warrant a substantial amount put in. Use the Lump Sum vs.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an. Find Out How With Our Free Report Get Facts.

Ad Compare Free Annuity Quotes Get the Most Guaranteed Income. Ad Find Annuity Vs Lump Sum. Projected annual income needs.

PV of Benefit 29806 this is the Lump Sum Amount you would receive today. Ad Learn More about How Annuities Work from Fidelity. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected.

Annuities suit risk-averse and low savings individuals who have just started out. Annuities are often complex retirement investment products. Annuities are often complex retirement investment products.

When Can You Cash Out An Annuity Getting Money From An Annuity

What Is An Annuity Rates Types Pros Cons

Annuity Vs Lump Sum Top 7 Useful Differences To Know

How Did You Feel At The Crossroads Of Deciding To Take Early Retirement Or Continuing On If You Had An Option Did You Cash Out With A Lump Sum Or Opt For

Annuity Buy Best Annuity Plans Of 2022 How It Works

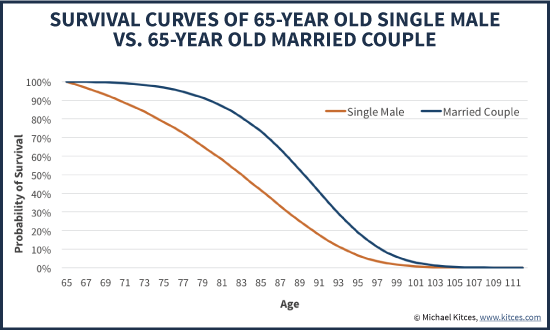

Strategies To Maximize Pension Vs Lump Sum Decisions

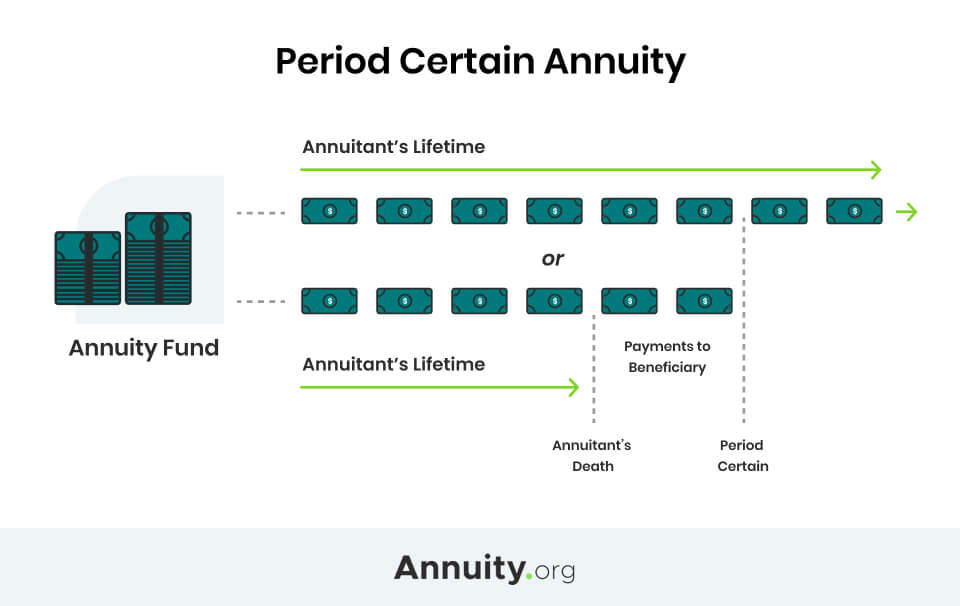

Annuity Payout Options Immediate Vs Deferred Annuities

Deferred Annuity Vs Immediate Annuity Explained In Detail Abc Of Money

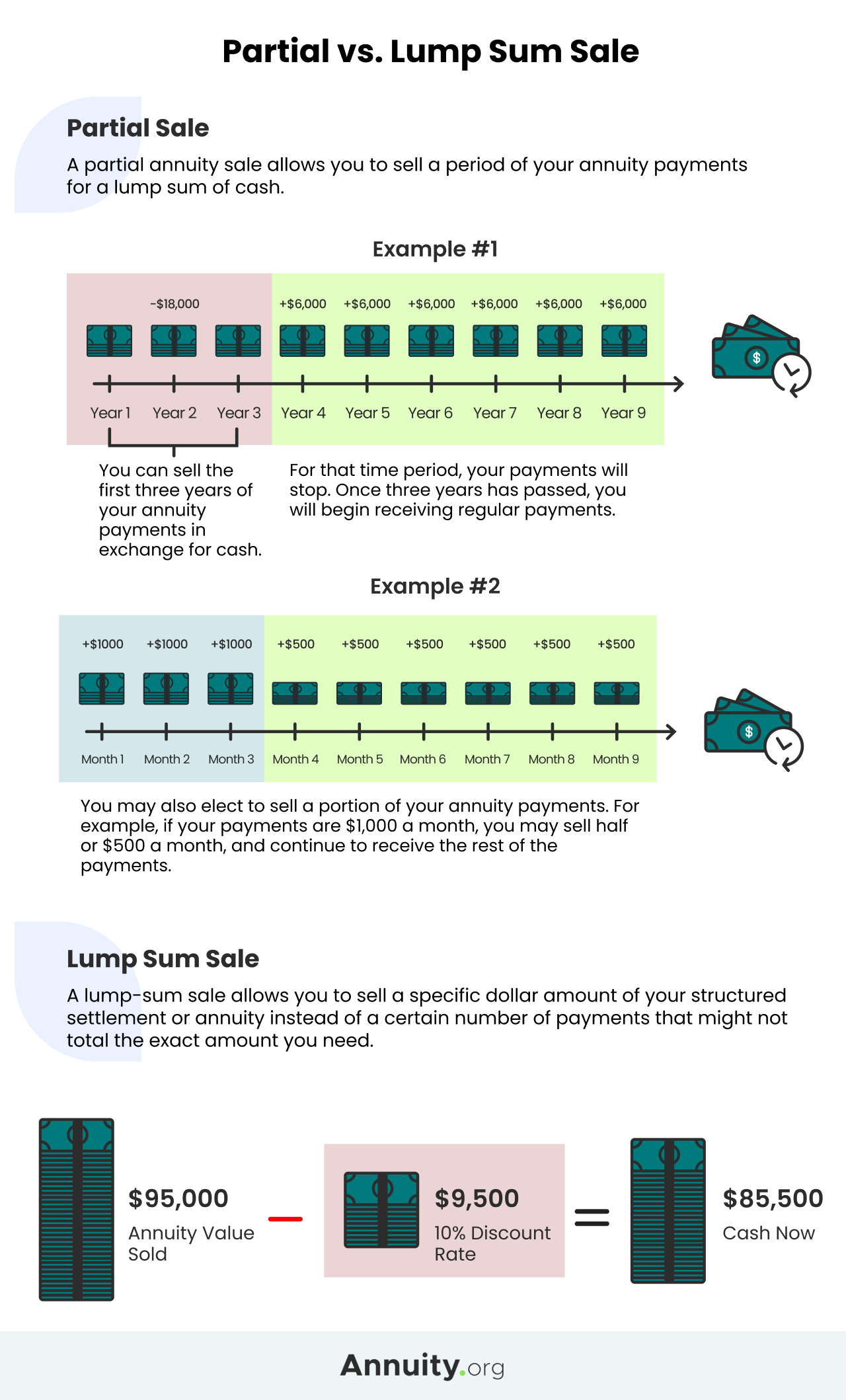

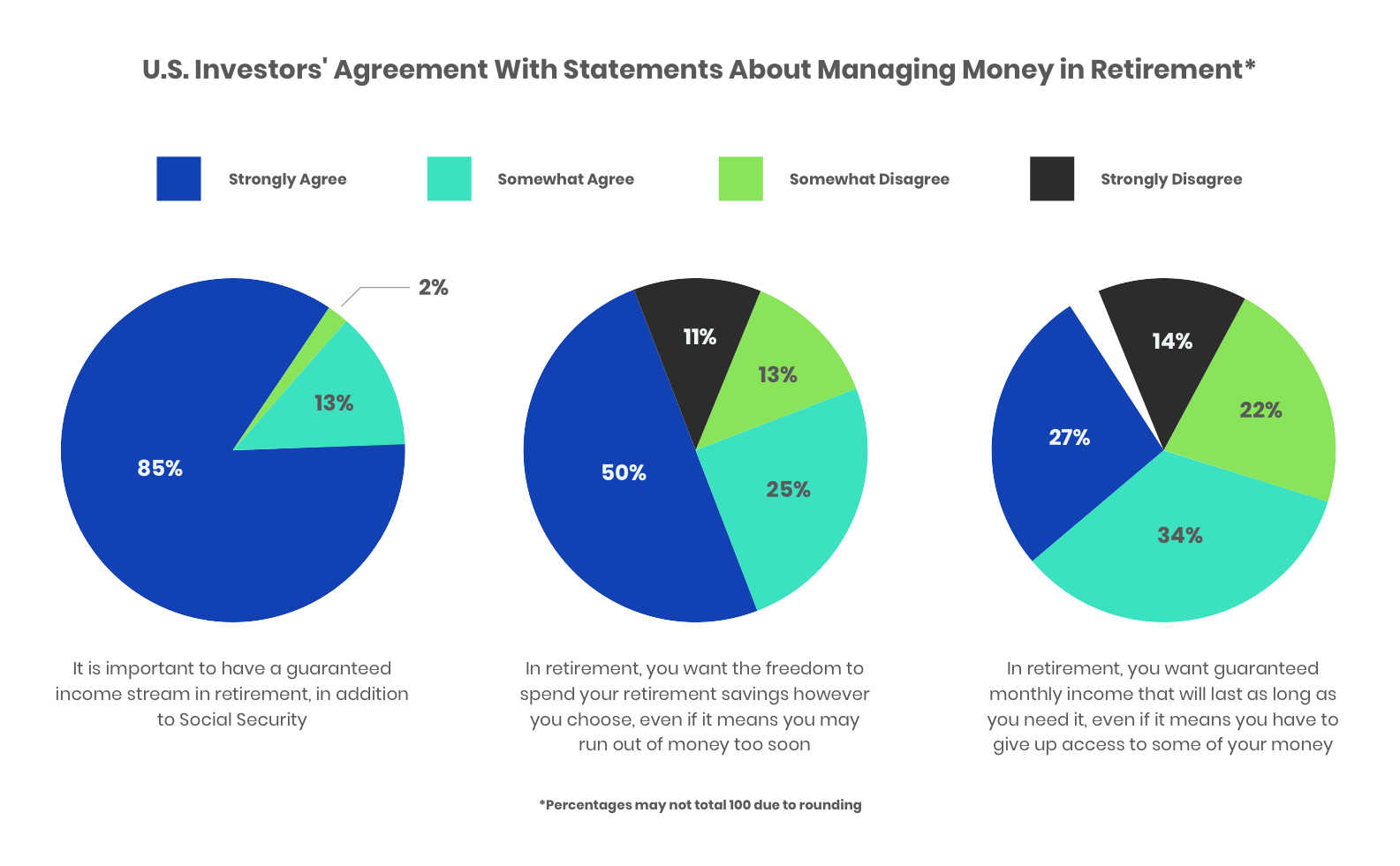

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Does An Annuity Plan Work For You Businesstoday

Are There Any Other Types Of Annuities Due

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Difference Between Annuity And Lump Sum Payment Infographics

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Vs Life Insurance Similar Contracts Different Goals

Lottery Payout Options Annuity Vs Lump Sum